kansas dmv sales tax calculator

The information you may need to enter into the tax and tag calculators may include. Home Motor Vehicle Sales Tax Calculator.

Motor Vehicle Fees And Payment Options Johnson County Kansas

Interactive Tax Map Unlimited Use.

. Registration fees for new resident vehicles registered outside the state of California. May 10 2021 and november 10. How Kansas Motor Vehicle Dealers and Leasing Companies Should Charge Sales Tax on Leases.

For your property tax amount refer to County Treasurer. For the property tax use our. A Recent changes in sales taxation of motor vehicle sales and leases.

Sales tax will be collected in the tag office if the vehicle was. Revised guidelines issued October 1 2009. The rate in sedgwick county is 75 percent.

Ad Lookup Sales Tax Rates For Free. Or less 4225 Autos 4501 lbs. The sales tax in Sedgwick County is 75 percent.

Kansas collects a 73 to 8775 state sales tax rate on the purchase. Vehicle property tax is due annually. There are also local taxes up to 1 which will vary depending on region.

Calculate By ZIP Codeor manually enter sales tax Kansas QuickFacts. The kansas state sales tax rate is currently 65. The Department collects taxes when an applicant applies for title on a motor vehicle trailer all-terrain vehicle boat or outboard motor unit.

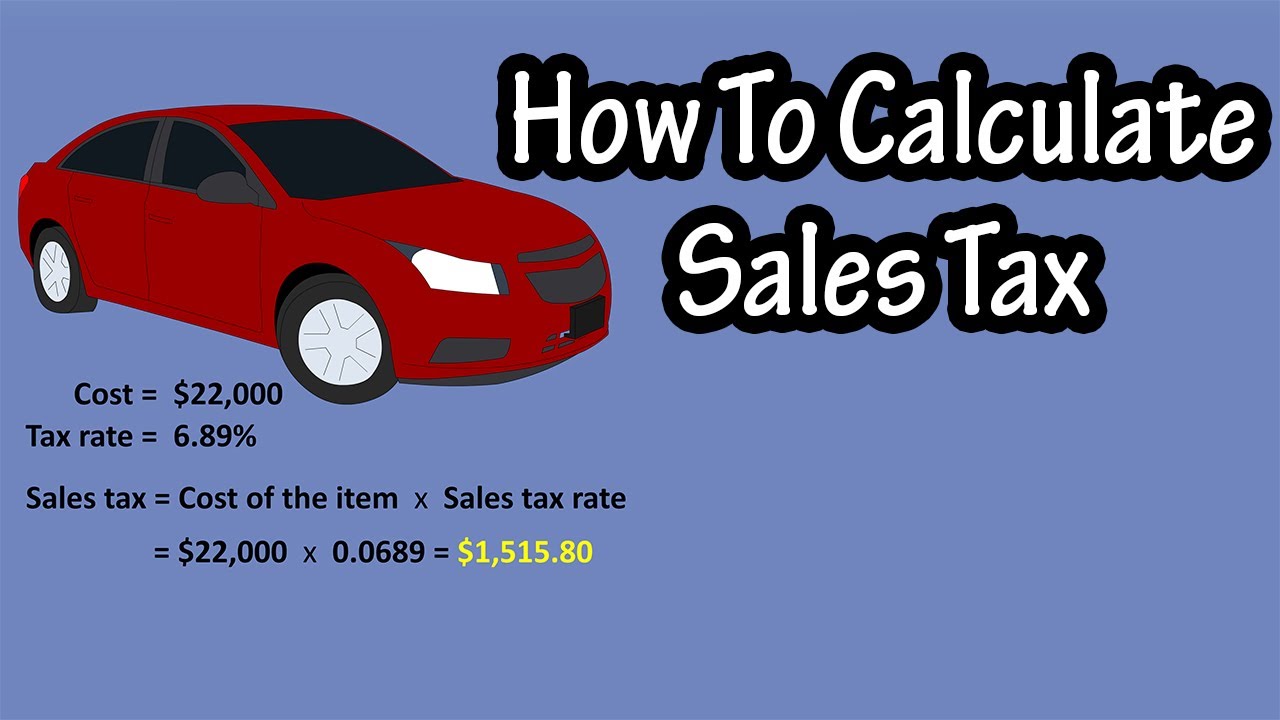

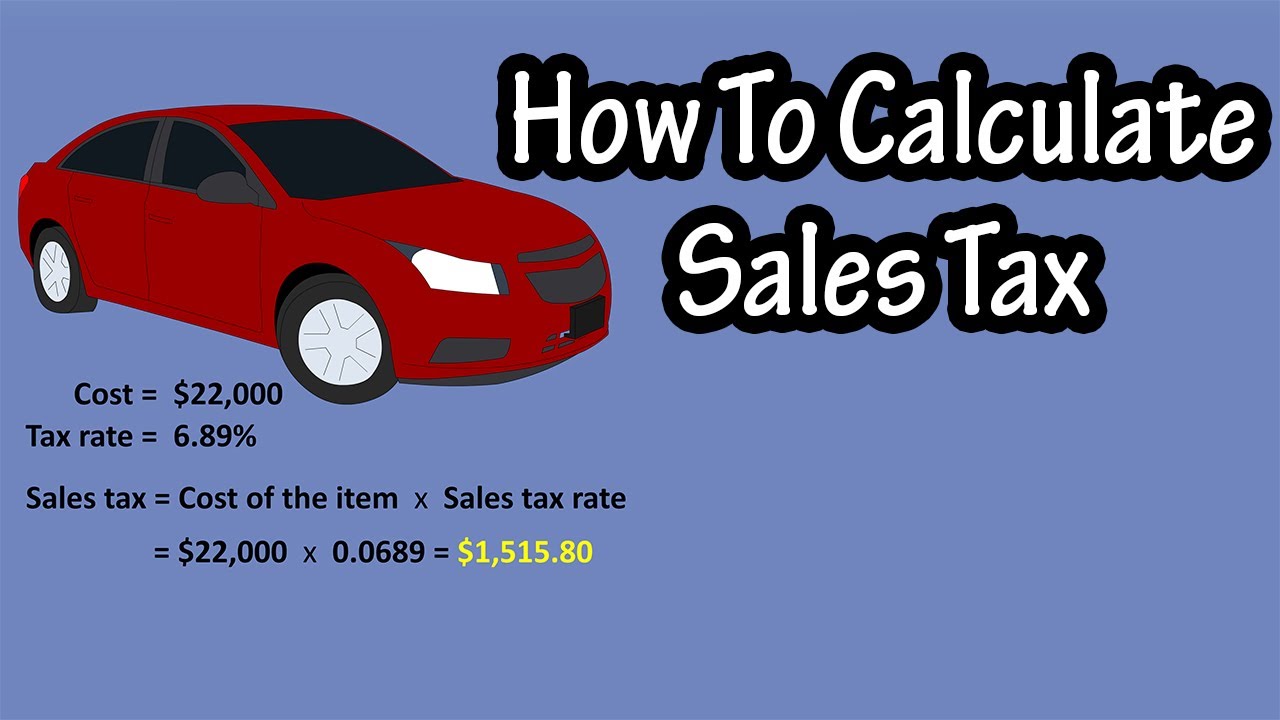

Or more 5225 Trucks 5225 Motorcycles 2825 Motorized Bicycle 2000 Property Tax. How to Calculate Kansas Sales Tax on a Car To calculate the sales tax on your vehicle find the total sales tax fee for the city andor county. In addition to taxes car.

Dealership employees are more in. The make model and year of your vehicle. Home motor vehicle sales tax calculator.

Vehicle property tax and fee estimator. Vehicle tax or sales tax is based on the vehicles net purchase price. Choose a search method VIN 10 character.

Kansas Vehicle Property Tax Check - Estimates Only Search for Vehicles by VIN -Or- Make Model Year -Or- RV Empty Weight Year Search By. Your vehicle renewals will cost. If you are unsure call any local car dealership and ask for the tax rate.

The median property tax on a 20990000 house is 270771 in kansas. Schools Special Hunting Opportunities. Registration fees for used vehicles that will be purchased in California.

There are also local taxes. The state sales tax rate in kansas is 650. Marion County Treasurers office is now offering a new service that you can use to estimate the cost of.

Title and Tag Fee is 1050. Johnson county kansas vehicle sales tax calculator. 104 out of 105 counties in Kansas offer some sort of drivers license andor ID card service.

Title fee is 800 tag fees vary according to type of vehicle. Its fairly simple to calculate provided you know your regions sales tax. When paying in person at the counter at either the Olathe or Mission location the credit card convenience fee is 26 of the total transaction amount with a 3 minimum subject to.

Kansas collects a 73 to 8775 state sales tax rate on the purchase of all vehicles. The minimum is 65. The date that you.

Modernization Fee is 400. You pay property tax when you initially title and register a vehicle and each year when you renew your vehicle tags and registration. The National Motor Vehicle Title Information.

The vehicle identification number VIN. For your property tax amount refer to County Treasurer. For your property tax amount use our Motor Vehicle Property Tax Estimator or call 316 660-9000.

Multiply the vehicle price. Kansas sales tax calculator by county. Use this online tool from the Kansas Department of Revenue to help calculate the amount of property tax you will owe on your vehicle.

Nebraska Sales Tax Small Business Guide Truic

Dmv Fees By State Usa Manual Car Registration Calculator

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

What S The Car Sales Tax In Each State Find The Best Car Price

Sales Tax On Cars And Vehicles In Kansas

Calculate The Sales Taxes In The Usa For 2022 Credit Finance

Tax Rates Gordon County Government

Kansas Vehicle Sales Tax Fees Find The Best Car Price

Kansas Vehicle Sales Tax Fees Find The Best Car Price

Vehicle Sales Tax Deduction H R Block

Connecticut Sales Tax Calculator Reverse Sales Dremployee

Calculate Auto Registration Fees And Property Taxes Geary County Ks

How To Calculate Sales Tax How To Find Out How Much Sales Tax Sales Tax Calculation Youtube

California Vehicle Sales Tax Fees Calculator

Missouri Car Sales Tax Calculator Missouri Country Club Plaza Cars For Sale

How To Calculate Sales Tax Video Lesson Transcript Study Com